Table of Content

You are required to pay 10-25% of the total property cost as ‘own contribution depending upon the loan amount. 75 to 90% of the property cost is what can be availed as a housing loan. In case of construction, home improvement and home extension loans, 75 to 90% of the construction/improvement/extension estimate can be funded. Go through the list of documents required and keep them ready before starting your home loan application process.

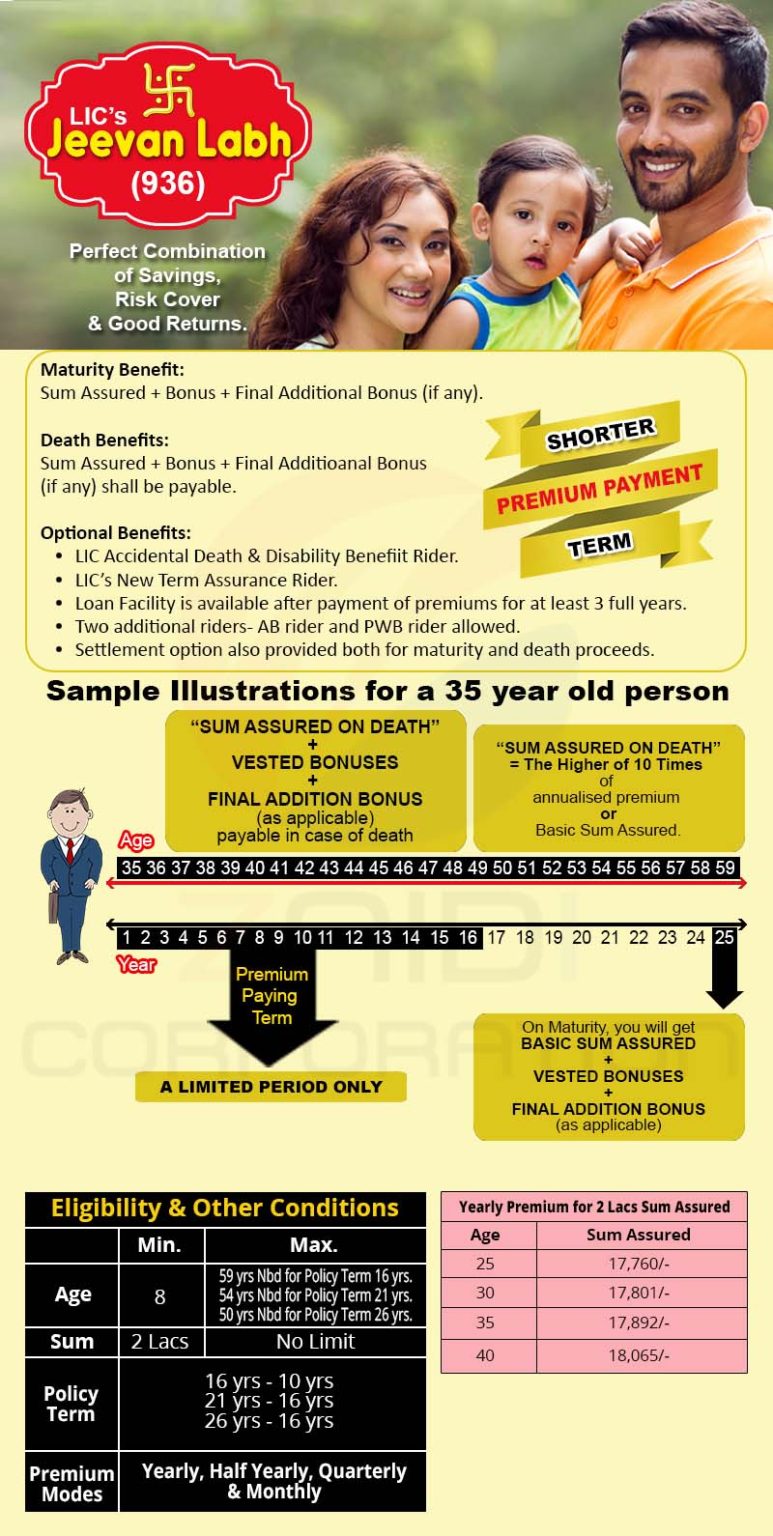

Attractive interest rates to make your Home Loans affordable and easier on your pocket. When expats make Dubai their home, they want to buy a property that suits their taste and fits within their financial means. An OTP will be sent to the selected Mobile number or selected Email ID of registered Loan account number. IRDAI is not involved in activities like selling insurance policies, announcing bonus or investment of premiums. Public receiving such phone calls are requested to lodge a police complaint.

Proof of Income

The documentation needed to be submitted along with your home loan application form is available here. This link provides a detailed checklist of KYC, Income and property related documents required for the processing of your home loan application. The checklist is indicative and additional documents could be asked for during the home loan sanction process. With minimal documentation, applying for a HDFC home loan is quick and hassle free. Our home loan experts are available to help you in your loan application process and offer you assistance every step of the way. In the event of you relocating back to India, HDFC reassesses the repayment capacity of the applicant based on Resident status and a revised repayment schedule is worked out.

Home loan is a form of secured loan that is availed by a customer to purchase a house. A housing loan is repaid through equated monthly installments which consists of a portion of the principal borrowed and the interest accrued on the same. HDFC is India’s premier housing finance company offering a wide range of home loan products that are customized to your needs and can be comfortably repaid over a longer tenure. HDFC’s end-to-end digital home loan application process, integrated branch network across the county and 24X7 online assistance can make your home owning journey a memorable one. You can prepay your home loan before the completion of your actual loan tenure. Please note that while there are no prepayment charges on floating rate home loans unless the same availed for business purposes.

Prepayment Charges

Naturally, a longer-term loan cuts down your monthly payment but increases the total interest amount. Borrowing capacity also goes up with a longer-term mortgage in Dubai. The first step of this process is to find out how much money you would need to pay upfront. This is usually done by obtaining a pre-approval from the bank.

Loans against property / Home Equity Loan for Business Purpose i.e. Fees on account of external opinion from advocates/technical valuers, as the case may be, is payable on an actual basis as applicable to a given case. Such fees is payable directly to the concerned advocate/technical valuer for the nature of assistance so rendered. Up to 1.25% of the loan amount or ₹3,000 whichever is higher, plus applicable taxes.

Approval & Disbursement of Home Loan

The Borrower will be required to submit such documents that HDFC may deem fit & proper to ascertain the source of funds at the time of prepayment of the loan. Before you start house hunting, you should obtain a mortgage pre-approval. This is crucial as you can narrow down your search as per your budget. Moreover, when you sign a sales agreement, you have to give a cheque for 10% of the purchase price. If you don’t have financial approval and are refused bank finance later, you will lose the deposit money to the bank.

In most cases, repayment value is no more than 25% of your monthly income. If you have other loans , that amount is also deducted from the calculations. Banks calculate borrowing capacity with their individual, unique formulas.

In this case, the valuation clause protects the buyer’s deposit. Alternatively, the valuation could be done before the signing of the sale agreement. ‘Home loans in Dubai’ is something that potential homeowners search for quite a bit when they plan on buying apartments or villas in Dubai. Similarly, another search term used often is ‘home loan for NRI in Dubai’. Considering the large populations of Indians in Dubai, this is not surprising.

A good house is essential for the all-round well-being of a family. Loans for construction on a freehold / lease hold plot or on a plot allotted by a Development Authority. HSPL officials do not communicate via generic email addresses such as Hotmail, Yahoo. All communications will always originate from a verifiable HSPL e-mail address (domains of @hdfcsales.co.in or @hdfcsales.com) and not from any free web based email accounts. Needs to review the security of your connection before proceeding.

You can start your work by learning more about the types of mortgages before making the final call. Credit Linked Subsidy Scheme under PMAY makes the home finance affordable as the subsidy provided on the interest component reduces the outflow of the customer on the home loan. The subsidy amount under the scheme largely depends on the category of income that a customer belongs to and the size of the property unit being financed. Transferring your outstanding home loan availed from another Bank / Financial Institution to HDFC is known as a balance transfer loan.

Understand thst they are well aware of banking guidelines pertaining to loans but they are very condescending when we raise a single query. Shyla and Aditya were rude and i was not happy with the tone in which they spoke to me. Incidental charges & expenses are levied to cover the costs, charges, expenses and other monies that may have been expended in connection with recovery of dues from a defaulting customer. A copy of the policy can be obtained by customers from the concerned branch on request. Delayed payment of interest or EMI shall render the customer liable to pay additional interest up to 24% per annum.

HDFC will determine your Home Loan Eligibility largely by your income and repayment capacity. Other important factors include your age, qualification, number of dependants, your spouse's income , assets & liabilities, savings history and the stability & continuity of occupation. Interest rates on home loan are lower than other types of loans. Availing a housing loan has become very affordable today. HSPL and HSPL authorized recruitment agents/ agencies do not ask for payments from applicants at any point in the recruitment process. I am a home loan customer and made a part payment which is not properly handled by them.

In case you wish to start principal repayment immediately you may opt to tranche the loan and start paying EMIs on the cumulative amounts disbursed. In an adjustable or floating rate loan, the interest rate on your loan is linked to your lender’s benchmark rate. Any movement in the benchmark rate will effectuate a proportionate change in your applicable interest rate. The reset can be according to the financial calendar, or they can be unique to each customer, depending on the first date of disbursement. Pre-EMI is the monthly payment of interest on your home loan.

You can repay an extra 10% of the principal amount each year facing no penalty. Before making any decision based on your home loan Dubai searches, it is best to seek professional advice. HDFC Credila Financial Services Limited is a subsidiary of HDFC Limited, a leading financial services company of India. Buying a house is one of the biggest and most important decisions of a lifetime.

Once you avail a HDFC home loan, you can access your home loan account online on our website. You can download account statements, interest certificates, request for disbursement and do much more. HDFC disburses loans for under construction properties in installments based on the progress of construction. Every installment disbursed is known as a 'part' or a 'subsequent' disbursement. For home loans and balance transfer loans, the maximum tenure is 30 years or till the age of retirement, whichever is lower.